We are a management consultancy firm driven by investors. We are not a fund raising platform. We first check and evaluate your business, whether it is scalable or not because… to get funds there are two major factors

– scalability

– profitability

Before going for the fund raise what we do is we evaluate and we give you an investor point of view. So we deep dive into the current revenue model that you have and we help you refine your model.

Whenever you are going for fund raise you are working with us or not there are certain metrics which any investor checks…

1) your business should have USP

2) your business should have a MOAT that is you should have competitive advantage

The consultation will include the following:

1. The idea is to get investor feelers of company value and deep feedback.

2. Enabling strategic investor onboarding.

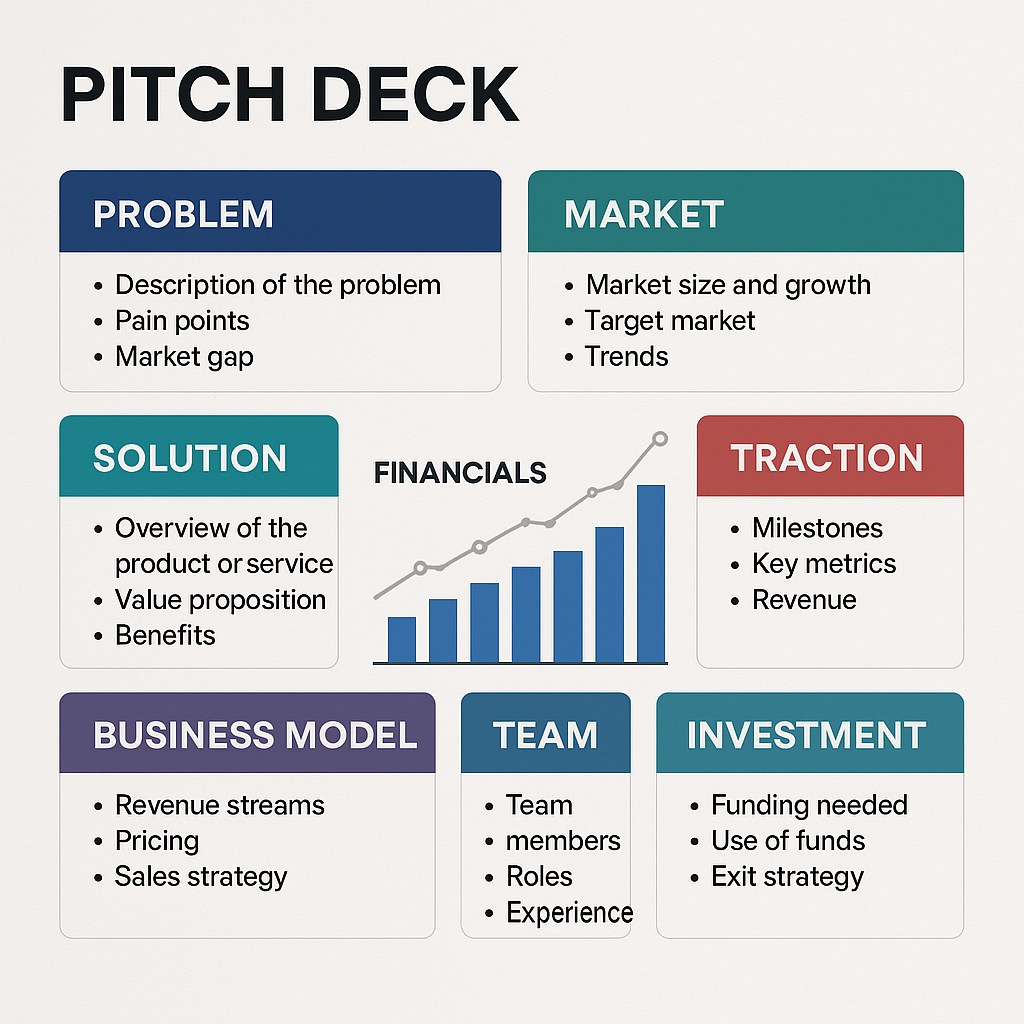

3. Develop investable deck, IM, and financials.

4. Set valuation, investor multiple, and exit strategy.

5. Determine instruments for investor issuance.

6. Establish cap table hygiene and structure funding rounds.

7. Conduct investor scoping and mapping before introductions.

8. Perform dry runs and mocks to minimize real-time objections.

9. Assist in negotiation and closing with the CA-CS-lawyer team.

10. Introduce at least two warm, relevant investors for onboarding synergy.

11. Explore investor platforms for additional opportunities.

Get in touch: dhruvdigitalspace@gmail.com